Family Separation Allowance

Updated: December 15, 2023

The family separation allowance (FSA) provides funds to qualifying service members with dependents to help offset expenses associated with having to maintain two households because of an enforced family separation.

There are two types of FSA, Type I and Type II. A service member may qualify to receive both types concurrently.

Type I: Family Separation Housing (FSH) Allowance

Family separation allowance Type I, Family Separation Housing (FSH) allowance, may be paid to offset the costs of maintaining separate residences when a service members is required to separate from their family and all the following conditions are met:

- The dependents do not live near the duty station.

- The dependents are not authorized to accompany the service member at the government’s expense.

- The service member has not been assigned government quarters.

There are two subcategories of FSH:

- FSH-B: Locations within the United States, including Alaska and Hawaii, are paid monthly at the “without-dependents” basic allowance for housing rate.

- FSH-O: Locations outside the U.S. are paid monthly at the “without-dependents” overseas housing allowance rate.

Type II: Family Separation Allowance

In general family separation allowance (FSA) is offered under the following situations:

- The service member’s family doesn’t live near the temporary duty station (generally considered within 50 miles, but there may be exceptions) and has not been authorized to move at the government’s expense.

- The family has been authorized to accompany the service member at the government’s expense, but a dependent cannot for medical reasons.

- A sailor is on duty aboard a ship that is away from the homeport continuously for more than 30 days.

- The service member is on temporary duty (or temporary additional duty) away from the permanent station for 30 days or more without dependents.

FSA may also be offered when dependents are evacuated from a dangerous area.

In dual-military families, only one member may receive FSA in a given month, even if both spouses are eligible.

Subcategories of FSA

Service members may qualify for FSA under more than one subcategory, but they can only receive one FSA payment.

FSA-Restricted (FSA-R): Applied when a service member’s family does not live near the TDY and is not authorized to accompany them at the government’s expense, or cannot due to medical reasons.

FSA-Ship (FSA-S): Requires duty aboard a ship that has been away from the home port for more than 30 consecutive days. The service member’s dependents must live near the sailor’s home port.

FSA-Temporary (FSA-T): Requires that the service member is on temporary duty for more than 30 consecutive days. The dependents must live near the permanent duty station but not near the TDY station.

Note: Depending on the branch of military service, additional requirements and restrictions may apply.

FSA Rates

In 2024, the National Defense Authorization Act increased the allowance for the first time in 20 years from $250 to $400.

How to Apply for FSA

To apply for FSA (types I and II), complete a DD Form 1561, “Statement to Substantiate Payment of Family Separation Allowance.,” and submit it to your servicing personnel office.

Most Popular BAH and Allowances Articles

2024 Basic Allowance for Housing (BAH) Rates

2024 BAH Calculator

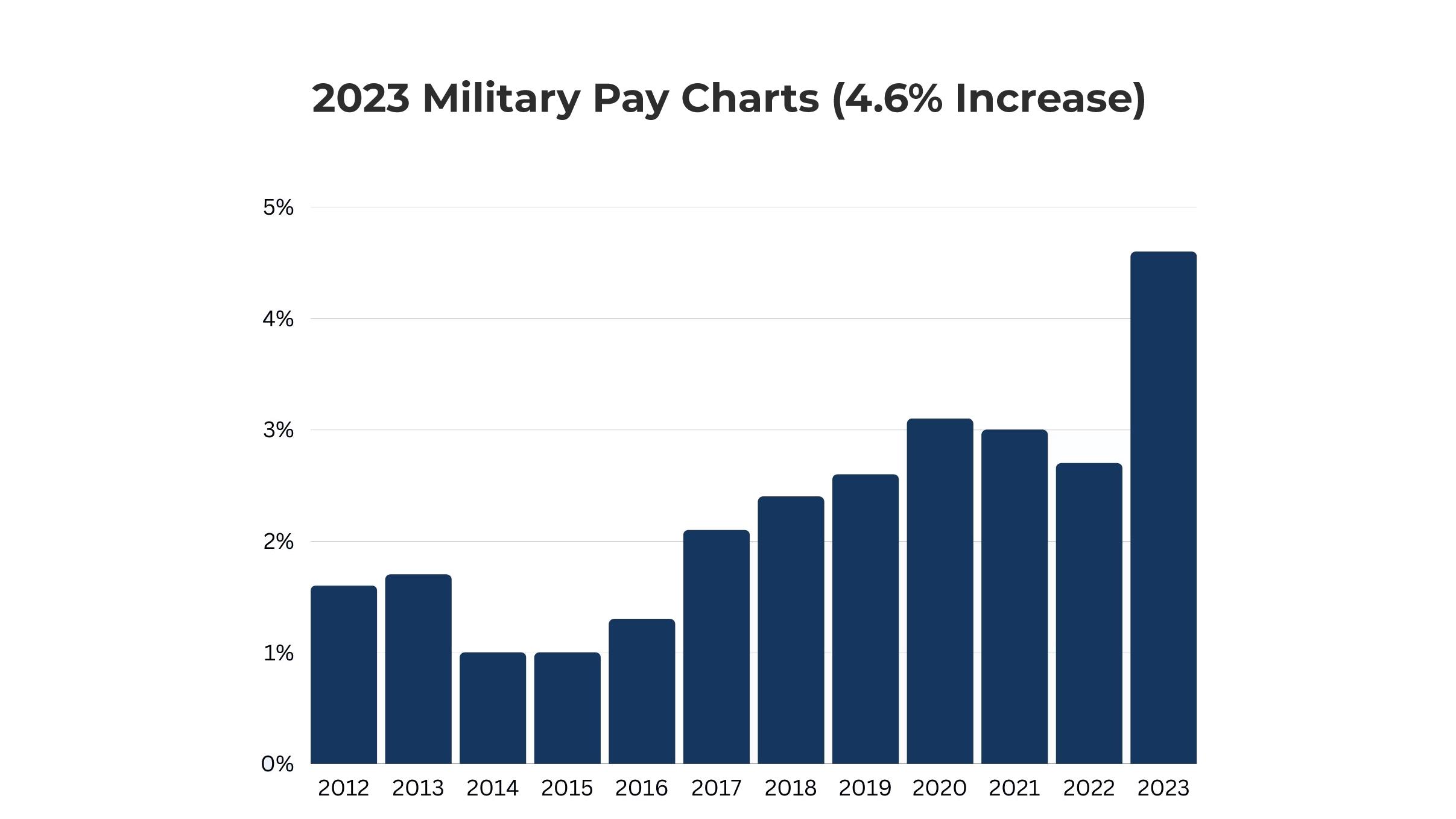

2024 Military Pay Charts

2024 BAH Rates By State and Local MHA

2024 Basic Allowance for Subsistence (BAS) Rates

2024 Military Pay Dates and LES Release Dates

2023 Basic Allowance for Housing (BAH) Rates